Investor Relations

Company information

- Company Registration Number 2822 of 1969-1970

- National Tax Number 13-06-0816613-7

- Sales Tax Registration Number 02-01-2000-001-19

| Board of Directors | |

|---|---|

| Mr. Zahid Majeed | Chairman |

| Mr. Abrar Hasan | Global CEO |

| Mr. Zouhair Abdul Khaliq | Independent Director |

| Mr. Ali H. Shirazi | Independent Director |

| Mr. Adam Fahy-Majeed | Executive Director |

| Mrs. Saadia Naveed | Non-Executive Director |

| Mrs. Noreen Hasan | Non-Executive Director |

| Audit Committee | |

|---|---|

| Mr. Zouhair A. Khaliq | Chairman |

| Mrs. Saadia Naveed | Member |

| Mrs. Noreen Hasan | Member |

| Mr. Adam Fahy Majeed | Member |

| Ms. Quratulain Mamsa | Secretary |

| Human Resource and Remuneration Committee | |

|---|---|

| Mr. Ali H. Shirazi | Chairman |

| Mrs. Noreen Hasan | Member |

| Mrs. Saadia Naveed | Member |

| Mr. Zouhair A. Khaliq | Member |

| Ms. Asma Yusuf | Secretary |

| Global Chief Financial Officer | |

|---|---|

| Mr. Syed Farhan Ali Rizvi |

| Legal Counsel | |

|---|---|

| Mr. Fazal Ur Rehman Hajano |

| Head of Internal Audit & Secretary Audit Committee | |

|---|---|

| Ms. Quratulain Mamsa |

| Internal Auditors | |

|---|---|

| EY Ford Rhodes Chartered Accountants | |

| Auditors | |||||||

|---|---|---|---|---|---|---|---|

| Messrs. KPMG Taseer Hadi & Co. Chartered Accountents, Shaikh Sultan Trust Building No. 2, Beaumont Road, Karachi-75530. | |||||||

| Management Committee | |

|---|---|

| Mr. Abrar Hasan | Global Chief Executive Officer |

| Mr. Hasan Sarwat | Chief Operating Officer – Pakistan Operations |

| Mr. Syed Farhan Ali Rizvi | Global Chief Financial Officer |

| Ms. Ivana Bajamic | Global Chief People & Corporate Reputation Officer |

| Mr. Ahmed Murad Khan | Senior Director Innovation, Research & Development |

| Mr. Ali Rashid | Senior Director Marketing |

| Ms. Asma Yusuf | Senior Director People & Workplace Services |

| Mr. Naveed Zafar | Senior Director Sales |

| Mr. Saleem Rafi Khilji | Senior Director Manufacturing |

| Mr. Faraz Khan | Senior Director Supply Chain |

| Mr. Shah Abdullah Raza | Senior Director Digital, Data & Technology |

| Mr. Adnan Naseer Warsi | Director Quality |

| Mr. Fazal ur Rehman Hajano | Director Legal |

| Share Registrar | |||||||

|---|---|---|---|---|---|---|---|

| CDC Share Registrar Services Limited CDC House, 99 – B, Block ‘B’, S.M.C.H.S., Main Shahra-e-Faisal Karachi – 74400, Pakistan Tel: Customer Support Services (Toll Free) 0800-CDCPL (23275) Fax: (92-21) 34326053 Email: [email protected] Website: www.cdcsrsl.com | |||||||

| Company Banks | |

|---|---|

| Allied Bank Limited | Askari Bank Limited |

| Bank Al Habib Limited | Bank Alfalah Limited (Islamic Banking Group) |

| Bank of Montreal | Faysal Bank Limited |

| Habib Bank AG Zurich - Dubai | Habib Bank Limited |

| Habib Bank Limited (UK) | Habib Bank Limited (UAE) |

| Habib Metropolitan Bank Limited | MCB Bank Limited |

| MCB Bank Limited - Dubai | Meezan Bank Limited |

| National Bank of Pakistan | Toronto Dominion Canada Trust Bank |

| United Bank Limited | |

| National Foods Locations | |

|---|---|

| Registered Office | 12/CL-6 Claremont Road, Civil Lines, Karachi-75530 Phone: (92-21) 38402022 & 36490029 Fax: (92-21) 35670996 |

| Port Qasim Plant | A-13, North Western Industrial Zone, Bin Qasim,Karachi. Phone: 021-3475-0373 – 7 |

| Nooriabad Plant | A393 Nooriabad Industrial Estate, Nooriabad, Karachi. Phone: 03000335287 |

| Faisalabad Plant | Plot #346/347, Phase II, M-3, Industrial City, (M-3IC) Sahianwala Interchange, Faisalabad

Phone: 0302-5825369 |

| Sales & SAP Offices | |

|---|---|

| Karachi Regional Office | Office#107&309, 1st Floor National Foods, Parsa Tower, Sharah-e-Faisal, Karachi |

| Lahore Regional Office | National Foods Limited 18-CCA Jamal Plaza DHA-8 Ex.Park View Lahore |

| Gujranwala Regional Office | Office # 4, Sixteenth Avenue Mall, 16-A, Industrial Estate. Grand Trunk Road, Gujranwala. |

| Rawalpindi Regional Office | Bilal Complex, 1st Floor Main PWD Double Road Rawalpindi. |

| Multan Regional Office | Office # 27, National Foods Limited, 3rd Floor,Bominji Square, Multan Cantt, Multan City. |

| NCOE | 20-C, Main Khayaban -e-Nishat, Ittehad Commercial Line 6, D.H.A Phase 6, Karachi, Sindh 75500, Pakistan Phone: 021-35842022 |

| Peshawar Sales Office | Office # 210, National Foods Limited, 2nd Floor ,Block-C City Towers Main University Road Peshawar |

| Kunri Office | Babu Iqbal Village, near Civil Hospital, Nabisar Road Kunri, Sindh 69160, 0238-557277 |

| List of Associated Companies | |

|---|---|

| ATC Holdings (Private) Limited | http://www.atcholdings.com.pk |

| English Biscuits Manufacturers (Pvt.) Limited | http://www.ebm.com.pk |

| Shield Corporation Limited | http://www.shield.com.pk |

| National Foods Limited Provident Fund | NA |

| National Foods DMCC | NA |

| EPICURE DMCC | NA |

Credit Rating

Due to competitive working capital management, we have been able to achieve yet another milestone of improvement in the long term credit rating from A + to AA- by JCR-VIS Credit Rating Company Limited. The improvement shows that the company is moving in the right direction as this will not only help in reducing financial charges by curtailing overall costs but will also increase the confidence of the financial institutions.

Financial Reports

- 2025

- 2024

- 2023

- 2022

- 2021

- 2020

- 2019

- 2018

- 2017

- 2016

- 2015

- 2014

- 2013

- 2012

- 2011

- 2010

- 2009

- 2008

- 2007

- 2006

Please click on the given link to download the financial report

-

Half-Yearly Report 2024-25

Format: PDF | filesize: -

1st Quarterly Report 2024-25

Format: PDF | filesize:

-

NFL 1st Quarter Report 2023-2024

Format: PDF | filesize: -

Half yearly Report 2024

Format: PDF | filesize: 4 MB -

3rd Quarterly Report 2024

Format: PDF | filesize: 3 MB -

Annual Report 2024

Format: PDF | filesize: 26 KB

-

NFL 1st Quarter Report 2022-23

Format: PDF | filesize: 5 MB -

NFL 2nd Quarter Report 2022-23

Format: PDF | filesize: 2 MB -

NFL 3rd Quarter Report 2022-23

Format: PDF | filesize: 2 MB -

Annual Report 2023

Format: PDF | filesize: 2 MB

-

1st Quarter Report

Format: PDF | filesize: 3 MB -

NFL Half Yearly Report 2021-22

Format: PDF | filesize: 3 MB -

3rd Quarter Report

Format: PDF | filesize: 3 MB -

Annual Report 2022

Format: PDF | filesize: 10 MB

-

NLF 1st Quarter Report 2020-21

Format: PDF | filesize: 8 MB -

NFL Half Yearly Report 2020-21

Format: PDF | filesize: 4 MB -

NFL 3rd QTR Report 2020-21

Format: PDF | filesize: 4 MB -

Annual Report 2021

Format: PDF | filesize: 29 MB

-

NFL 1st Quarter Report 2019-20

Format: PDF | filesize: 5 MB -

NFL Half Yearly Report 2019-20

Format: PDF | filesize: 2 MB -

NFL 3rd QTR Report 2019-20

Format: PDF | filesize: 3 MB -

Annual Report 2020 - Part 1

Format: PDF | filesize: 9 MB -

Annual Report 2020 - Part 2

Format: PDF | filesize: 8 MB

-

NFL 1st Quarter Report 2018-19

Format: PDF | filesize: 3 MB -

NFL Half Yearly Report 2018-19

Format: PDF | filesize: 2 MB -

NFL 3rd QTR Report 2018-19

Format: PDF | filesize: 5 MB -

Annual Report 2018-19

Format: PDF | filesize: 35 MB

-

NFL 1st Quarter Report 2017-18

Format: PDF | filesize: 2 MB -

NFL Half Yearly Report 2017-18

Format: PDF | filesize: 3 MB -

NFL 3rd QTR Report 2017-18

Format: PDF | filesize: 3 MB -

Annual Report 2017-18

Format: PDF | filesize: 14 MB

-

NFL 1st Quarter Report 2016-17

Format: PDF | filesize: 1 MB -

NFL Half Yearly Report 2016-17

Format: PDF | filesize: 2 MB -

NFL 3rd QTR Report 2016-17

Format: PDF | filesize: 2 MB -

Annual Report 2016-17

Format: PDF | filesize: 14 MB

-

NFL 1st Quarter Report 2015-16

Format: PDF | filesize: 1 MB -

Half Yearly Report 2015-16

Format: PDF | filesize: 1 MB -

NFL 3rd QTR Report 2015-16

Format: PDF | filesize: 9 MB -

Annual Report 2015-16

Format: PDF | filesize: 6 MB

-

NFL 1st Quarter Report 2014-15

Format: PDF | filesize: 3 MB -

NFL Half Yearly Report 2014-15

Format: PDF | filesize: 1 MB -

NFL 3rd QTR Report 2014-15

Format: PDF | filesize: 1 MB -

Annual Report 2014-15

Format: PDF | filesize: 5 MB

-

NFL 1st Quarter Report 2013-14

Format: PDF | filesize: 564 KB -

NFL Half Yearly Report 2013-14

Format: PDF | filesize: 1 MB -

NFL 3rd QTR Report 2013-14

Format: PDF | filesize: 838 KB -

Annual Report 2013-14

Format: PDF | filesize: 8 MB

-

NFL 1st Quarter Report 2012-13

Format: PDF | filesize: 7 MB -

NFL Half Yearly Report 2012-13

Format: PDF | filesize: 2 MB -

NFL 3rd QTR Report 2012-13

Format: PDF | filesize: 3 MB -

Annual Report 2012-13

Format: PDF | filesize: 10 MB

-

NFL 1st Quarter Report 2011-12

Format: PDF | filesize: 1 MB -

NFL Half Yearly Report 2011-12

Format: PDF | filesize: 19 MB -

NFL 3rd QTR Report 2011-12

Format: PDF | filesize: 10 MB -

Annual Report 2011-12

Format: PDF | filesize: 8 MB

-

NFL 1st Quarter Report 2010-11

Format: PDF | filesize: 1 MB -

NFL Half Yearly Report 2010-11

Format: PDF | filesize: 5 MB -

Annual Report 2010-11

Format: PDF | filesize: 17 MB

-

NFL 1st Quarter Report 2009-10

Format: PDF | filesize: 1 MB -

NFL Half Yearly Report 2009-10

Format: PDF | filesize: 357 KB -

NFL 3rd QTR Report 2009-10

Format: PDF | filesize: 372 KB -

Annual Report 2009-10

Format: PDF | filesize: 8 MB

-

NFL 1st Quarter Report 2008-09

Format: PDF | filesize: 749 KB -

NFL 3rd QTR Report 2008-09

Format: PDF | filesize: 2 MB -

Annual Report 2008-09

Format: PDF | filesize: 1 MB

-

NFL 1st Quarter Report 2007-08

Format: PDF | filesize: 506 KB -

NFL Half Yearly Report 2007-08

Format: PDF | filesize: 606 KB -

NFL 3rd QTR Report 2007-08

Format: PDF | filesize: 87 KB -

Annual Report 2007-08

Format: PDF | filesize: 2 MB

Ratios

| Financial Ratios | Unit | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|

| Profitability Ratios | |||||||

| Gross Profit Ratio | % | 27.3 | 28.3 | 28.5 | 28.2 | 29.1 | 28.8 |

| Operating Profit to Sale | % | 7.2 | 8.6 | 9.0 | 8.5 | 9.2 | 8.3 |

| Net Profit before Tax to Sales | % | 4.2 | 7.7 | 7.9 | 7.6 | 8.0 | 7.1 |

| Net Profit after Tax to Sales | % | 3.2 | 5.9 | 6.0 | 5.7 | 5.7 | 5.7 |

| EBITDA Margin to Sales | % | 9.9 | 11.0 | 11.5 | 11.0 | 12.1 | 10.5 |

| Operating Leverage Ratio | % | 61.0 | 85.3 | 118.1 | 48.6 | 193.1 | 351.3 |

| Return on Equity | % | 16.1 | 28.4 | 28.5 | 26.5 | 26.6 | 27.2 |

| Return on Capital Employed | % | 24.2 | 27.6 | 34.4 | 31.4 | 32.0 | 31.7 |

| Return on Assets | % | 6.2 | 9.7 | 10.0 | 9.9 | 10.9 | 10.3 |

| Financial Ratios | Unit | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|

| Liquidity Ratios | |||||||

| Current Ratio | Times | 1.3 | 1.2 | 1.1 | 1.2 | 1.2 | 1.1 |

| Quick / Acid Test Ratio | Times | 0.5 | 0.4 | 0.4 | 0.6 | 0.5 | 0.3 |

| Cash to Current Liabilities | Times | 0.1 | (0.1) | (0.1) | 0.1 | 0.2 | 0.03 |

| Cash Flow from Operations to Sales | % | 8.0 | 4.6 | 3.2 | 7.3 | 10.4 | 7.9 |

| Working Capital Turnover | Times | 19.08 | 25.49 | 32.79 | 21.10 | 30.8 | (131.0) |

| Financial Ratios | Unit | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|

| Efficiency Ratios | |||||||

| No. of Days in Inventory | Days | 83.1 | 96.0 | 89.3 | 85.3 | 90.4 | 91.1 |

| No. of Days in Receivables | Days | 13.7 | 16.9 | 14.8 | 12.4 | 15.7 | 17.0 |

| No. of Days in Payables | Days | 26.8 | 24.3 | 20.9 | 22.7 | 24.5 | 25.7 |

| Operating Cycle | Days | 70.0 | 88.6 | 83.2 | 75.0 | 81.7 | 82.4 |

| Asset Turnover | Times | 2.0 | 1.9 | 1.9 | 2.0 | 2.0 | 2.0 |

| Inverntory Turnover | Times | 4.4 | 3.8 | 4.1 | 4.3 | 4.0 | 4.0 |

| Receivables Turnover | Times | 26.7 | 21.6 | 24.6 | 29.4 | 23.2 | 21.5 |

| Payables Turnover | Times | 13.6 | 15.0 | 17.5 | 16.1 | 14.9 | 14.2 |

| Revenue / Employee | Rs. | 111,088 | 85,524 | 68,526 | 59,126 | 54,422 | 44,269 |

| Net Income / Employee | Rs. | 2,933 | 4,085 | 3,163 | 2,506 | 2,286 | 1,820 |

| No. of Employees | No. | 953 | 929 | 859 | 788 | 722 | 753 |

| Financial Ratios | Unit | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|

| Investment / Market Ratios | |||||||

| Earnings Per Share | Rs. | 8.2 | 13.6 | 10.4 | 7.5 | 6.3 | 5.6 |

| Price Earning Ratio | Times | 21.3 | 7.2 | 13.9 | 24.3 | 25.4 | 17.2 |

| Dividend Yield Ratio | % | 3.7 | 2.5 | 3.5 | 2.2 | 2.0 | 2.2 |

| Dividend Payout Ratio N1 | % | 79.3 | 18.4 | 48.1 | 53.0 | 50.7 | 38.4 |

| Dividend Cover Ratio N1 | Times | 1.3 | 5.5 | 2.1 | 1.9 | 2.0 | 2.6 |

| Cash Dividend Per Share | Rs. | 6.5 | 2.5 | 5.0 | 5.0 | 5.0 | 4.0 |

| Cash Dividend | % | 130 | 50 | 100 | 100 | 100 | 80 |

| Stock Dividend Per Share | Rs. | - | - | - | 1.3 | 1.3 | 1.2 |

| Stock Dividend | % | - | - | - | 25.0 | 25.0 | 20.0 |

| Market Value Per Share at the end of the year |

Rs. | 174.7 | 98.4 | 144.8 | 229.0 | 250.5 | 179.0 |

| Low during the year | Rs. | 97.0 | 89.9 | 141.9 | 188.6 | 133.0 | 147.5 |

| High during the year | Rs. | 186.1 | 164.8 | 230.6 | 304.0 | 267.5 | 310.0 |

| Breakup Value Per Share without Surplus on Revaluation of Fixed Assets N2 |

Rs. | 60.3 | 55.6 | 39.7 | 31.2 | 26.0 | 40.5 |

| Market Capitalisation (in millions) | Rs. | 40,727.6 | 22,938.6 | 33,750.5 | 42,710.5 | 37,365.6 | 22,256.0 |

| Financial Ratios | Unit | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|---|

| Capital Structure Ratios | |||||||

| Financial Leverage Ratio | % | 120.3 | 98.6 | 87.7 | 77.9 | 49.9 | 63.5 |

| Weighted Average Cost of Debt | % | 16.7 | 10.8 | 6.7 | 7.2 | 10.9 | 9.4 |

| Gearing Ratio (Total Debt / Total Debt + Shareholders Equity) | % | 44.1 | 42.9 | 39.4 | 38.2 | 27.1 | 38.5 |

| Interest Coverage Ratio | Times | 2.4 | 4.7 | 8.8 | 9.4 | 7.7 | 7.1 |

| No. of Ordinary Shares (in millions) | EA | 233 | 233 | 233 | 186 | 149 | 124 |

| N1 - Calculated on Parent's share. | |||||||

| N2 - Calculated on shares as at 30 June 2024. |

Horizontal Analysis

| National Foods Limited Horizontal Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| INCOME STATEMENT | % | % | % | % | % | % |

| Sales - Net | 34.3% | 41.3% | 31.6% | 20.5% | 18.4% | 12.3% |

| Cost of Sales | 36.2% | 41.7% | 31.0% | 22.1% | 17.8% | 16.0% |

| Gross Profit | 29.5% | 40.2% | 33.1% | 16.6% | 19.8% | 4.2% |

| Distribution costs | 31.8% | 33.4% | 39.7% | 16.8% | 16.2% | (5.3%) |

| Impairment loss on trade debts | 150.2% | -78.8% | 45.5% | 0.2% | (2.8%) | (72.7%) |

| Administrative Expense | 53.9% | 56.8% | 22.2% | 16.3% | 8.8% | 24.9% |

| Other Expense | -9.4% | -2.1% | 112.6% | 3.1% | 5.8% | (43.0%) |

| Administration, Distribution & Other Opertating Exp and impairment | 47.8% | 48.1% | 30.3% | 15.0% | 8.5% | 11.2% |

| Other Income | -69.7% | 41.2% | 387.2% | (47.1%) | 0.9% | 364.4% |

| Financial Charges | 124.1% | 149.9% | 47.3% | (8.1%) | 20.9% | 44.8% |

| Profit before taxation | -26.8% | 37.2% | 37.4% | 14.0% | 34.0% | 46.8% |

| Taxation - net | -28.1% | 29.8% | 36.8% | (0.2%) | 86.6% | 140.7% |

| Profit after taxation | -26.3% | 39.7% | 37.6% | 19.6% | 20.4% | 33.4% |

| National Foods Limited Horizontal Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| BALANCE SHEET | % | % | % | % | % | % |

| Issued, subscribed and paid up capital | 0.0% | 0.0% | 25.0% | 25.0% | 20.0% | 20.0% |

| Unappropriated Profit | 11.1% | 29.5% | 18.4% | 17.7% | 21.3% | 23.5% |

| Non controlling interest | 24.8% | 131.9% | 20.9% | 20.9% | 93.5% | 38.4% |

| Exchange revaluation reserve | -24.7% | 120.0% | 20849.4% | (105.4%) | (136.0%) | 154.9% |

| Total Equity | 8.5% | 39.9% | 27.3% | 20.0% | 20.5% | 25.6% |

| National Foods Limited Horizontal Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| Long Term Obligations | 67.2% | 170.5% | 22.9% | (5.2%) | 71.1% | 209.7% |

| Total Long-term Liabilities and shareholder equities |

29.1% | 68.4% | 26.3% | 13.2% | 30.9% | 43.1% |

| National Foods Limited Horizontal Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| Fixed Assets, CWIP Intangibles | 31.4% | 45.2% | 46.9% | 9.1% | 15.9% | 12.6% |

| Other Non current assets | -8.0% | -26.5% | -56.4% | 61.7% | 90.1% | (1.4%) |

| Current Assets | 4.7% | 44.7% | 30.3% | 48.7% | 12.5% | 29.7% |

| Total Assets | 15.5% | 44.8% | 35.9% | 31.1% | 14.2% | 21.5% |

| Current Liabilites & Provisions | 1.5% | 26.4% | 44.5% | 52.6% | (0.9%) | 6.9% |

| Net Assets | 28.9% | 68.4% | 26.3% | 13.2% | 30.9% | 43.1% |

Vertical Analysis

| National Foods Limited Vertical Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| INCOME STATEMENT | % | % | % | % | % | % |

| Sales - Net | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| Cost of Sales | 72.7% | 71.7% | 71.5% | 71.8% | 70.9% | 71.2% |

| Gross Profit | 27.3% | 28.3% | 28.5% | 28.2% | 29.1% | 28.8% |

| Distribution cost | 15.1% | 15.4% | 16.3% | 15.4% | 15.9% | 16.2% |

| Impairment loss on trade debts | 0.0% | 0.0% | 0.1% | 0.1% | 0.1% | 0.1% |

| Administrative Expense | 4.9% | 4.3% | 3.9% | 4.2% | 4.3% | 4.7% |

| Other Expense | 0.3% | 0.5% | 0.7% | 0.4% | 0.5% | 0.5% |

| Other Income | 0.3% | 1.4% | 1.4% | 0.4% | 0.9% | 1.0% |

| Financial Charges | 3.0% | 1.8% | 1.0% | 0.9% | 1.2% | 1.2% |

| Profit before taxation | 4.2% | 7.7% | 7.9% | 7.6% | 8.0% | 7.1% |

| Taxation - net | 1.0% | 1.8% | 2.0% | 1.9% | 2.3% | 1.5% |

| Profit after taxation | 3.2% | 5.9% | 6.0% | 5.7% | 5.7% | 5.7% |

| National Foods Limited Vertical Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| BALANCE SHEET | % | % | % | % | % | % |

| Issued, subscribed and paid up capital | 4.5% | 5.8% | 9.8% | 9.9% | 5.2% | 5.5% |

| Unappropriated Profit | 37.7% | 43.8% | 57.0% | 60.8% | 33.8% | 35.2% |

| Non controlling interest | 8.6% | 8.9% | 6.5% | 6.8% | 3.7% | 2.4% |

| Exchange revaluation reserve | 3.7% | 6.4% | 4.9% | 0.0% | -0.4% | 1.3% |

| Total Equity | 54.6% | 64.9% | 78.2% | 77.6% | 42.3% | 44.3% |

| National Foods Limited Vertical Analysis | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Long Term Obligations | 45.4% | 35.1% | 21.8% | 22.4% | 15.5% | 11.4% |

| Total Long-term Liabilities and shareholder equities |

100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

| National Foods Limited Vertical Analysis | 2024 | 2023 (Restated) | 2022 (Restated) | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|---|

| Fixed Assets, CWIP Intangibles | 80.7% | 79.1% | 91.7% | 78.9% | 81.8% | 92.4% |

| Other Non current assets | 0.1% | 0.2% | 0.5% | 1.3% | 0.9% | 0.6% |

| Current Assets | 95.0% | 117.0% | 136.1% | 131.9% | 100.4% | 116.9% |

| Total Assets | 175.9% | 196.3% | 228.3% | 212.2% | 183.2% | 209.9% |

| Current Liabilites & Provisions | 75.9% | 96.3% | 128.3% | 112.2% | 83.2% | -109.9% |

| Net Assets | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |

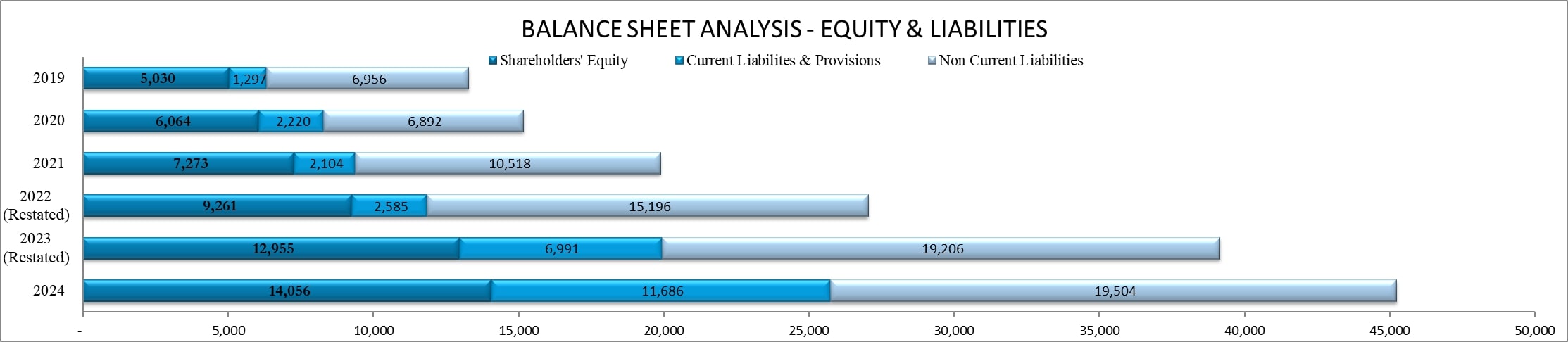

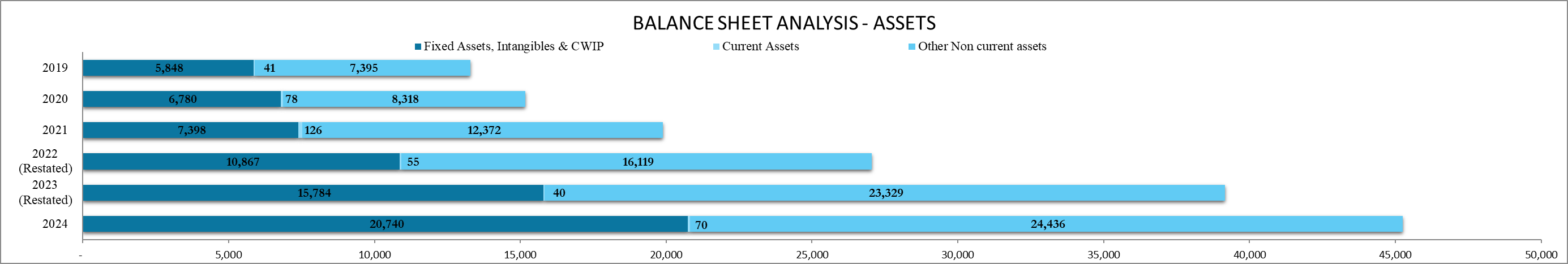

Balance Sheet Analysis

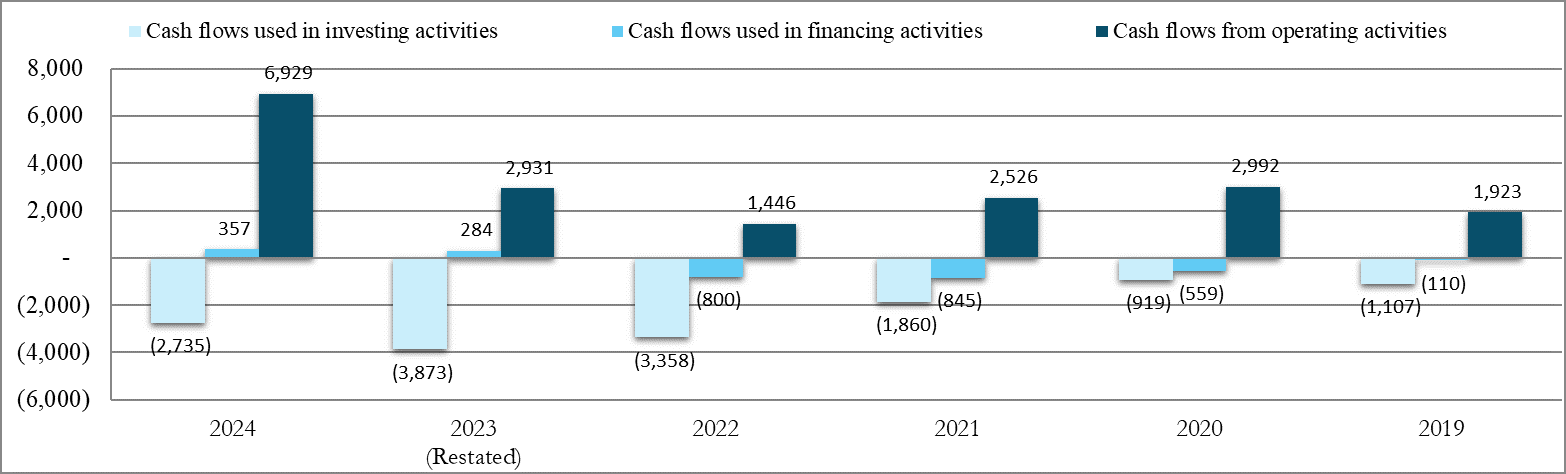

Cash Flow

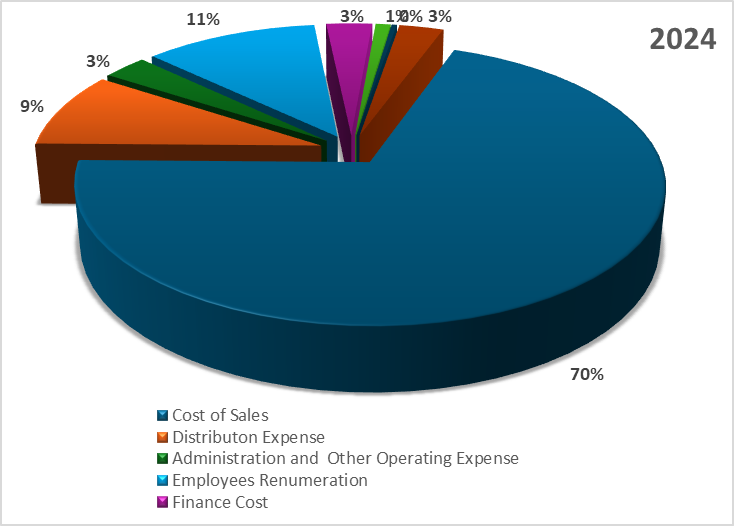

Value Addition

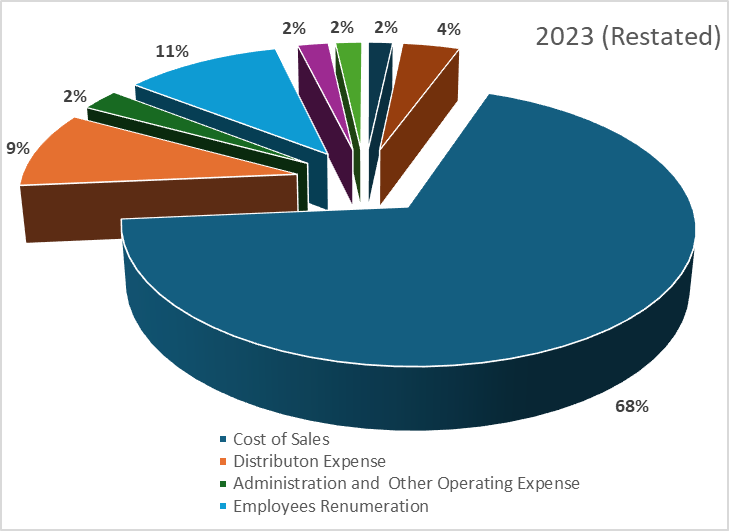

STATEMENT OF VALUE ADDED

AND ITS DISTRIBUTION

| Value Addition | 2024 (Rupees in thousand) | % | 2023 (Restated) (Rupees in thousand) | % |

|---|---|---|---|---|

| Revenue | 86,375,106 | 64,322,287 | ||

| Other Income | 276,399 | 912,120 | ||

| 86,651,505 | 65,234,407 | |||

| Cost of Sales | 60,388,991 | 70% | 44,404,895 | 68% |

| Distributon Expense | 7,720,500 | 9% | 6,047,573 | 9% |

| Administration and Other Operating Expense | 2,509,854 | 3% | 1,718,481 | 3% |

| Employees Renumeration | 9,802,348 | 11% | 6,944,724 | 11% |

| Finance Cost | 2,597,265 | 3% | 1,158,889 | 2% |

| Income Tax | 837,637 | 1% | 1,165,121 | 2% |

| Dividend to shareholders | 293,874 | 0% | 1,269,907 | 2% |

| Profit retained for Investment & Future Growth | 2,501,036 | 3% | 2,524,817 | 4% |

| 86,651,505 | 100% | 65,234,407 | 100% |

Election of Directors

-

Annexure II - NFL Results of Voting on

Format: PDF | filesize: 633 KB

Resolutions Execution Report -

Annexure III - NFL Scrutinizer Report

Format: PDF | filesize: 5 MB

(Regulation 11(A)) -

List of Proxies October 21 2024

Format: PDF | filesize: 208 KB -

Profile of Persons given consent to

Format: PDF | filesize: 307 KB

act as Director -

Notice published in English Newspaper

Format: PDF | filesize: 265 KB

under Section 159(4) of the Companies

Act, 2017 -

Notice published in Urdu Newspaper

Format: PDF | filesize: 308 KB

under Section 159(4) of the Companies

Act, 2017 -

Notice of Annual General Meeting of Shareholders

Format: PDF | filesize: 110 KB -

Form of Proxy in English Language

Format: PDF | filesize: 101 KB -

Form of Proxy in Urdu Language

Format: PDF | filesize: 425 KB -

List of Beneficial Ownership of National

Format: XLSX | filesize: 1 MB

Foods Limited

Forms

-

Ballot Paper published in English

Format: PDF | filesize: 583 KB

Newspaper -

Ballot Paper published in Urdu

Format: PDF | filesize: 560 KB

Newspaper -

Form of Proxy (English)

Format: PDF | filesize: 2 MB -

Form of Proxy (Urdu)

Format: PDF | filesize: 2 MB -

E Dividend Mandate Letter (English)

Format: PDF | filesize: 2 MB -

E Dividend Mandate Letter (Urdu)

Format: PDF | filesize: 2 MB -

Undertaking for determination of

Format: PDF | filesize: 2 MB

Residential Status for the Purpose of Tax Deduction on Dividend -

Affidavit for Zakat Exemption

Format: PDF | filesize: 2 MB

Contact Details

If you are shareholder,you can contact us at:

-

[email protected]

-

+92-21-35662687

-

+92-21-35684870

-

12/CL-6 Claremont Road, Civil Lines, Karachi 75530 P.O Box No, 15509

Send filled grievance form to [email protected]

-

Grievance form Urdu

Format: PDF | filesize: 1.85 MB -

Grievance form English

Format: PDF | filesize: 56 KB

SECP Investor Complaint

DISCLAIMER: In case your complaint has not been properly redressed by us, you may lodge your complaint with Securities and Exchange Commission of Pakistan (the “SECP”). However, please note that SECP will entertain only those complaints which were at first directly requested to be redressed by the Company and the company has failed to redress the same. Further, the complaints that are not relevant to SECP’s regulatory domain/competence shall not be entertained.

Stock Information

STOCK EXCHANGE TRADING SYMBOL

NATF

National Foods Limited stock is traded on the Pakistan Stock Exchange, under the symbol “NATF”.

Please visit the stock exchange website for further details.

Stock Price

Click the link below to find out updated Stock Price.

See Now

Share Register

CDC Share Registrar Services Limited

CDC House, 99-B, Block ‘B”

S.M.C.H.S. Main Shahra-e Faisal

Karachi – 74400, Pakistan.

-

(92-21) 111-111-500

-

(92-21) 34326053

-

[email protected]

Free Float

-

Free Float of Shares january 2025

Format: PDF | filesize: 2 KB -

Free Float of Shares September 2024

Format: PDF | filesize: 2 KB -

Free Float of Shares April 2024

Format: PDF | filesize: 2 KB -

Free Float of Shares June 2024

Format: PDF | filesize: 2 KB -

Free Float of Shares March 2023

Format: PDF | filesize: 2 MB -

Free Float of Shares June 2023

Format: PDF | filesize: 2 MB -

Free Float of Shares September 2023

Format: PDF | filesize: 2 MB -

Free Float of Shares December 2023

Format: PDF | filesize: 2 MB

Session 2024

Session 2023

Session 2022

Session 2021

Investors and analysts can submit questions in advance for the corporate briefing session at: [email protected]

Notice of Extraordinary General Meeting

Annual General Meeting Notices

-

51st Annual General Meeting - Notice

Format: PDF | filesize: 116 KB -

51st Annual General Meeting - English

Format: PDF | filesize: 612 KB -

51st Annual General Meeting - Urdu

Format: PDF | filesize: 624 KB -

52nd Annual General Meeting - Urdu

Format: PDF | filesize: 507 KB -

52nd Annual General Meeting - English

Format: PDF | filesize: 5 MB -

53rd Annual General Meeting - Notice

Format: PDF | filesize: 12 MB

Board Meetings

Other Notices

-

Notice of Credit of Interim Cash Dividend

Format: PDF | filesize: 1 MB -

PSX Newspaper Clip Book Closure

Format: PDF | filesize: 1 MB -

Final Notice to the Shareholders Unclaimed Shares and Unclaimed Cash Divided December 30 & 31

Format: PDF | filesize: 683 KB -

Financial Results for the Period Ended 31st December 2024

Format: PDF | filesize: 1 MB -

Financial Results for the 1st Quarter ended September 30, 2024

Format: PDF | filesize: 1 MB -

Standard Request Letter For Hard Copy

Format: PDF | filesize: 110 KB -

E-Dividend Mandate Form

Format: PDF | filesize: 112 KB -

Financial Results For the Year Ended 30th June 2024

Format: PDF | filesize: 1.50 MB -

Financial Results For the Quarter Ended December 31, 2023

Format: PDF | filesize: 750 KB -

PSX Letter

Format: PDF | filesize: 447 KB -

Credit of Final Cash Dividend

Format: PDF | filesize: 740 KB -

Financial Results 3rd Quarter ended 31-03-2023

Format: PDF | filesize: 603 KB -

Financial Results 2nd Quarter ended December 31,2022

Format: PDF | filesize: 644 KB -

Financial Results 1st Quarter ended September 30,2022

Format: PDF | filesize: 324 KB -

Financial Results 4th Quarter ended 30-06-2022

Format: PDF | filesize: 533 KB -

Financial Results 3rd Quarter ended 31-03-2022

Format: PDF | filesize: 616 KB -

Financial Results 2nd Quarter ended 31-12-2021

Format: PDF | filesize: 426 KB -

Financial Results 1st Quarter ended 30-09-2021

Format: PDF | filesize: 574 KB -

Financial Results for the Quarter ended 30 June 2021

Format: PDF | filesize: 808 KB -

Proxy Form 01

Format: PDF | filesize: 484 KB -

Proxy Form 02

Format: PDF | filesize: 3 MB -

Financial Results for the Quarter ended 31-03-2021

Format: PDF | filesize: 604 KB -

Financial Results for the Quarter ended 31-12-2020

Format: PDF | filesize: 633 KB -

Financial Result for the Quarter ended 30-09-2020

Format: PDF | filesize: 737 KB -

Proxy 2020

Format: PDF | filesize: 1 MB -

Dividend Mandate - CDC

Format: PDF | filesize: 155 KB -

Financial Results for the year ended 30th June, 2020

Format: PDF | filesize: 794 KB -

NATF-Free Float of Shares Report through CDS Functionality as of June 30, 2020

Format: PDF | filesize: 3 KB -

3rd QTR Financial Results of National Foods 31st March 2020

Format: PDF | filesize: 645 KB -

National Foods Half Yearly Report 31st Dec 2019

Format: PDF | filesize: 523 KB -

National Foods Quarterly Report, 30 Sept 2019

Format: PDF | filesize: 2 MB -

Financial Result for the 1st Quarter Ended 30th September, 2019

Format: PDF | filesize: 483 KB -

ATC & Mrs. M.E. Majeed's Proxy Form

Format: PDF | filesize: 470 KB -

NATF Submitted-Report-30-09-2019

Format: PDF | filesize: 3 KB -

Notice of Annual General Meeting 2019

Format: PDF | filesize: 2 MB -

Annual Financial Results for the year ended 30th June, 2019

Format: PDF | filesize: 645 KB -

Financial results of 3rd Qtr 2019 Results

Format: PDF | filesize: 988 KB -

Press Clipping published Notice of EOGM

Format: PDF | filesize: 563 KB -

Financial Results for the Half Year ended December 31, 2018

Format: PDF | filesize: 667 KB -

Dispatch of Bonus Share Certificates and Credit in CDS

Format: PDF | filesize: 633 KB -

Payment of Cash Dividend

Format: PDF | filesize: 612 KB -

Dividend Credit

Format: PDF | filesize: 143 KB -

Compliance Certificate

Format: PDF | filesize: 163 KB -

Financial Results for the 1st Quarter as at 30th September, 2018

Format: PDF | filesize: 557 KB -

Proxies - 2018

Format: PDF | filesize: 2 MB -

Notice of Election of Directors

Format: PDF | filesize: 58 KB -

Financial Results for the year ended June 30, 2018

Format: PDF | filesize: 761 KB -

Quality and Food Safety Policy

Format: PDF | filesize: 235 KB -

Compliance Certification 2017

Format: PDF | filesize: 174 KB -

Correction in Book Closure

Format: PDF | filesize: 177 KB -

Financial Results for year ended 30 June 2017

Format: PDF | filesize: 679 KB -

Financial Results as of 31st March 2017

Format: PDF | filesize: 584 KB -

Shareholders list without CNIC - 2016

Format: PDF | filesize: 87 KB -

Compliance Certificate

Format: PDF | filesize: 155 KB -

Financial Results as of 30th Sept 2016

Format: PDF | filesize: 506 KB -

Director's Report 2016

Format: PDF | filesize: 175 KB -

Financial Results as of 30 June 2016

Format: PDF | filesize: 615 KB -

CNIC & Dividend Mandate

Format: PDF | filesize: 33 KB -

Secretarial Compliance

Format: PDF | filesize: 22 KB -

Tax Deduction on Dividend Income

Format: PDF | filesize: 42 KB -

Notice of Election of Directors

Format: PDF | filesize: 575 KB -

Financial Results for the Year Ended June 30, 2023

Format: PDF | filesize: 817 KB -

Business Recorder Ballot Paper - English

Format: PDF | filesize: 2 MB -

Nawa-i-waqt Ballot Paper - Urdu

Format: PDF | filesize: 434 KB -

Notice for Interim Cash Dividend and Book Closure

Format: PDF | filesize: 411 KB -

Final Notice Regarding Unclaimed Dividends To Vest With The Federal Government

Format: PDF | filesize: 425 KB -

Notice of Credit of Interim Dividend

Format: PDF | filesize: 457 KB